Introduction

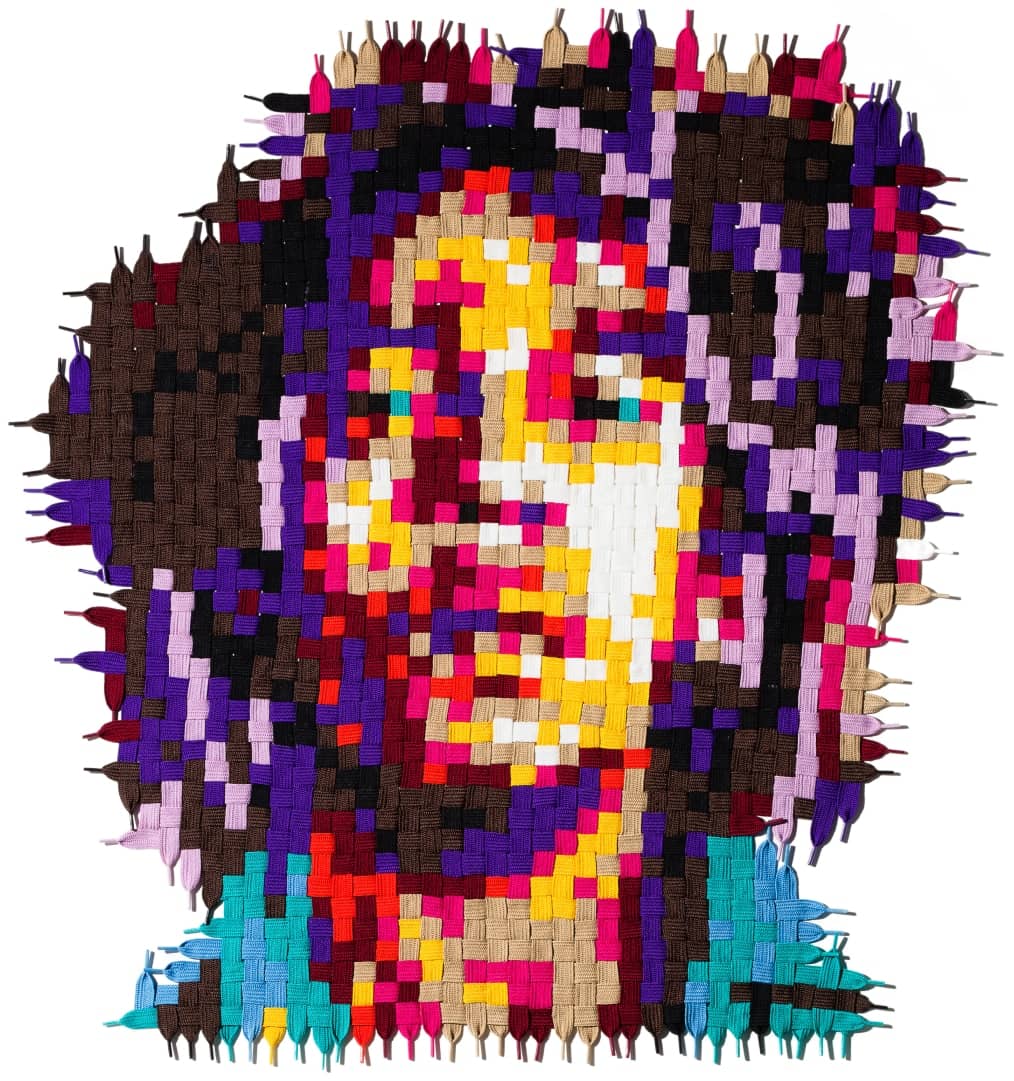

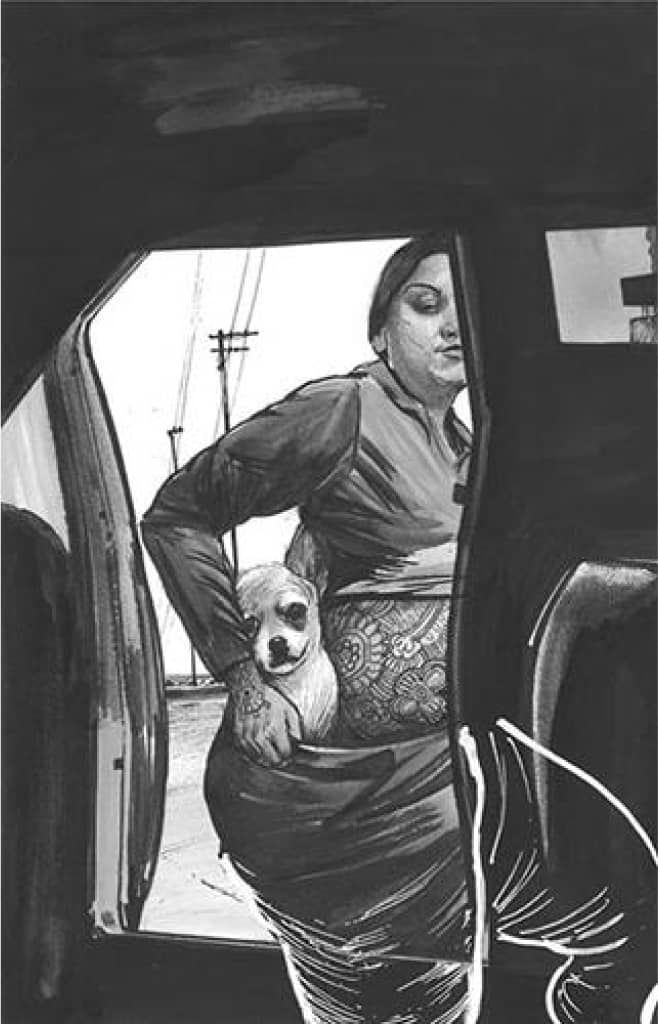

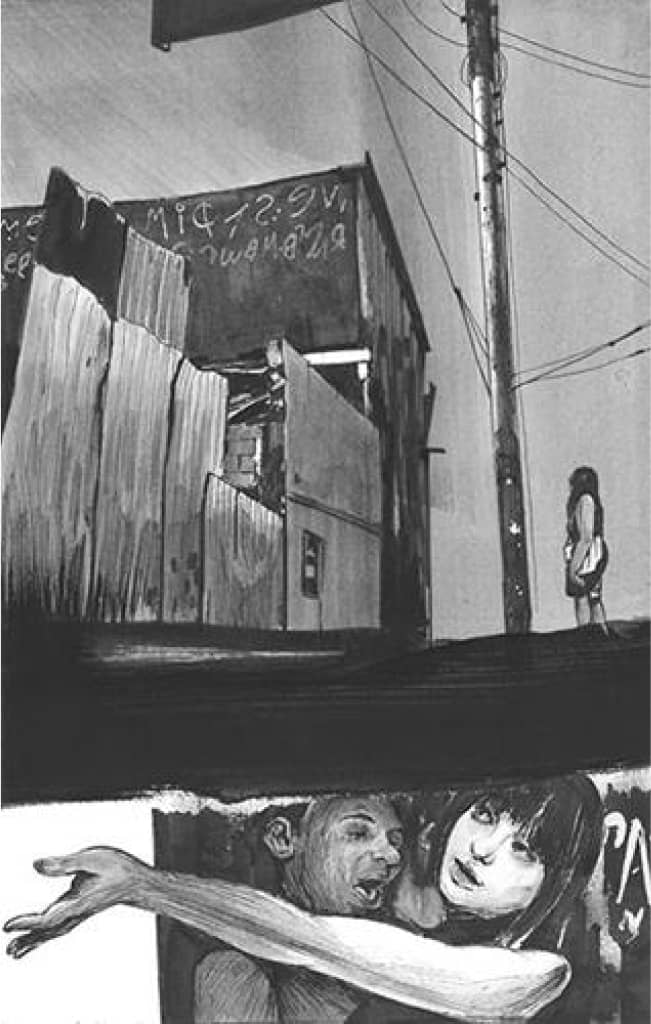

For this year’s annual report, we chose “think broadly” as the theme and selected the work of 30 multicultural artists from Progressive’s expanding collection of contemporary art. This diverse set of artists reflects our versatility as an organization as well as our willingness to step back and assess the many potential ways with which to grow. The painting A CHANGE IS GONNA COME was created by artist Jeffrey Gibson, who combines indigenous history and textiles with words he believes resonate not only for Native American people but people of all backgrounds. Gibson states, “Ultimately, everyone is at an intersection of multiple cultures, times, histories. The world is shifting and changing and if you’re engaged in the world, you are also shifting and changing.” At Progressive, we relish change and know that it’s not only inevitable, but exciting and it fuels us to come to work every day with a mindset to win, and win in the right way. The multiple vantage points shown throughout this report offer a glimpse into our unique company culture and enduring business.

About Progressive

The Progressive Group of Insurance Companies, in business since 1937, is one of the country’s largest auto insurance groups, the largest seller of motorcycle policies, the market leader in commercial auto insurance, and one of the top 15 homeowners carriers, based on premiums written. Progressive is committed to becoming consumers’ number one choice and destination for auto and other insurance by providing competitive rates and innovative products and services that meet customers’ needs throughout their lifetimes, including superior mobile, online, and in-person customer service, and best-in-class, 24-hour claims service.

Progressive companies offer consumers choices in how to shop for, buy, and manage their insurance policies. Progressive offers personal and commercial auto, motorcycle, boat, recreational vehicle, and home insurance. We operate our Personal and Commercial Lines businesses through more than 35,000 independent insurance agencies throughout the U.S. and directly from the Company online, by phone, or on mobile devices. Our homeowners business is underwritten by Progressive Home, and other select carriers, throughout the United States.